First of all, what is the Zestimate?

Zillow is using an AVM ( Automated Valuation Model) to come up with your home’s value. AVM’s are a service that can provide real estate property valuations using mathematical modeling combined with a database. Most AVMs calculate a property’s value at a specific point in time by analyzing values of comparable properties. Some also take into account current asking prices, previous surveyor valuations, historical house price movements and user inputs (e.g. number of bedrooms, property improvements, etc.)

An AVM typically includes:

- An indicative market value (capital value or rental value) for a single residential property.

- Information on the subject property and recent history of like properties.

- Comparable sales analysis of like properties.

- Current like properties being actively marketed.

Besides Zillow, lenders, appraisers and mortgage investors use AVMs in risk management fields, estimating home equity, and quickly coming up with approximate property valuations in a portfolio. Fannie Mae now purchases qualified homes without an appraisal only using and AVM value.

So how accurate are AVM’s and Zillow in particular?

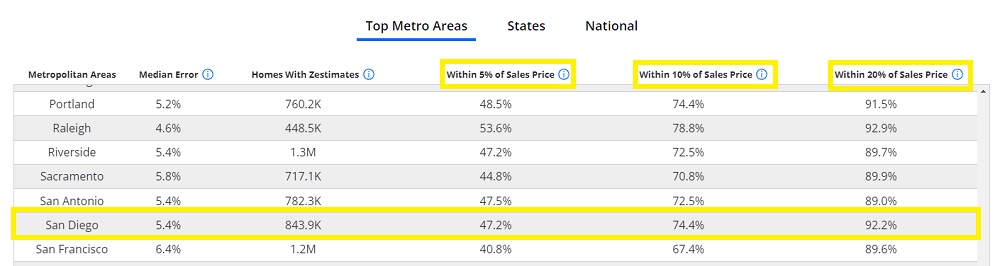

According to Zillows website here is how accurate their off market Value is:

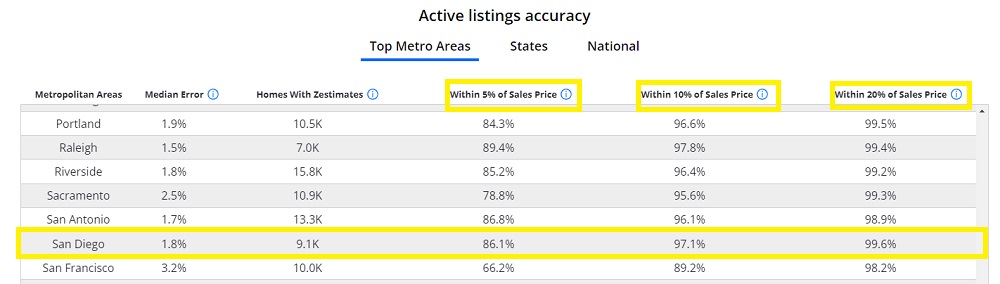

Active listings accuracy:

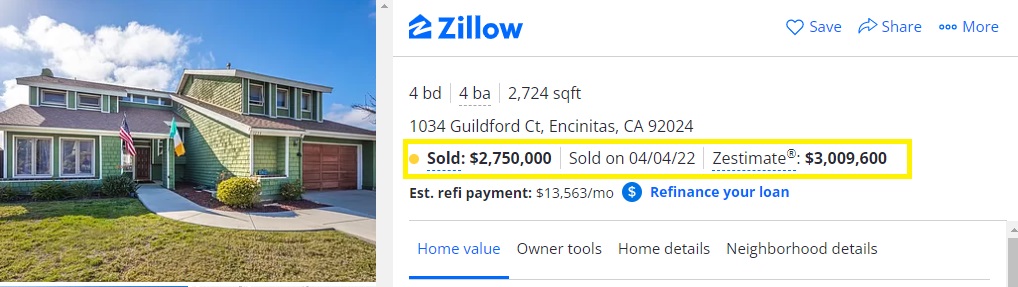

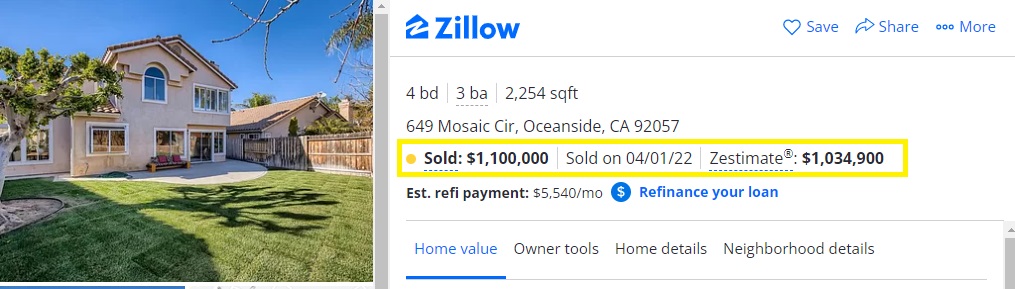

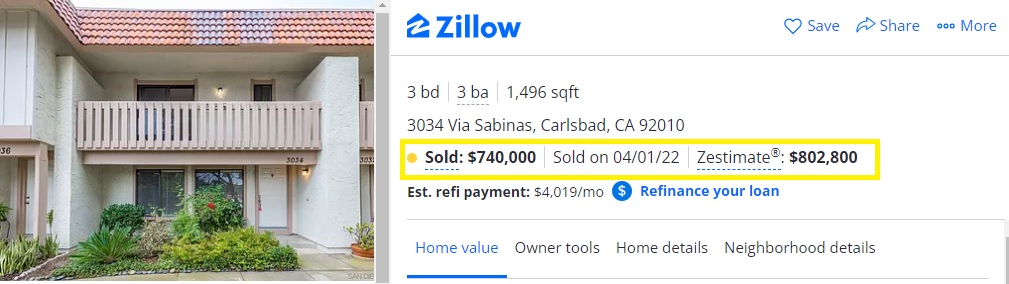

Here are 3 recent sold properties with the sale price and the Zestimate:

The Zestimate is off from 6 – 9%. Overvalued 2 properties and undervalued 1. According to Zillow itself, their off market valuation is significantly worse then the active listing valuation. That is because they get a lot of help from a real estate brokers listing price to dial in the value.

I don’t doubt that AVM’s will get more accurate in the future, but for now, the Zestimate is only that, an estimate.

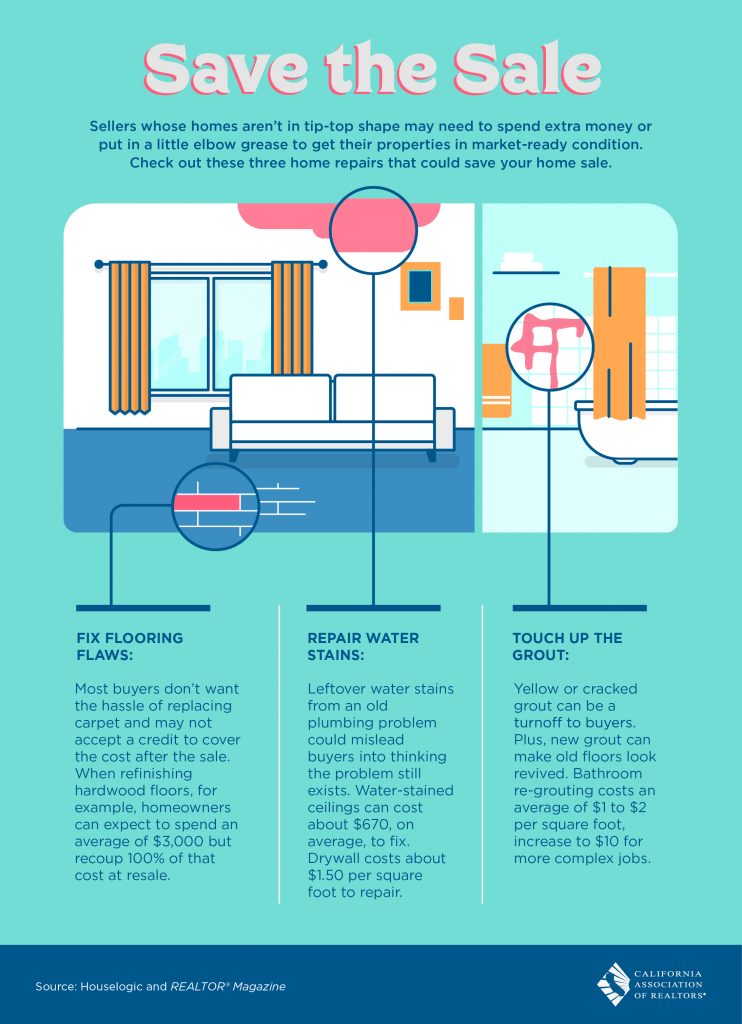

If you are going to sell, get a professional Real Estate Brokers price opinion to dial in your homes value.

What is my Home Worth