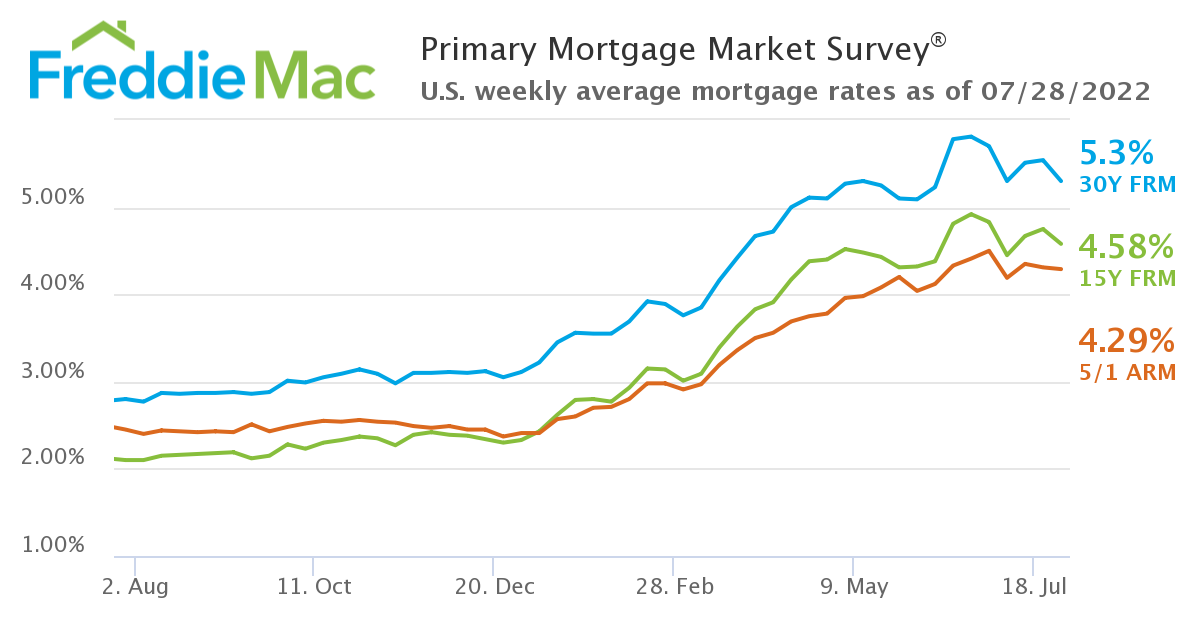

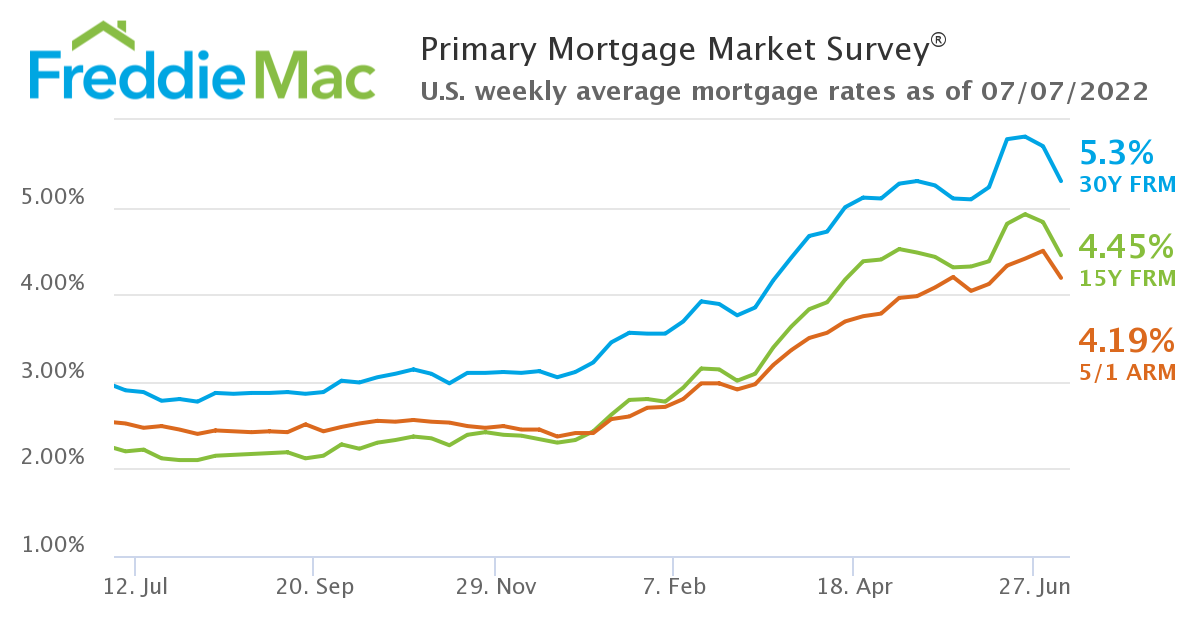

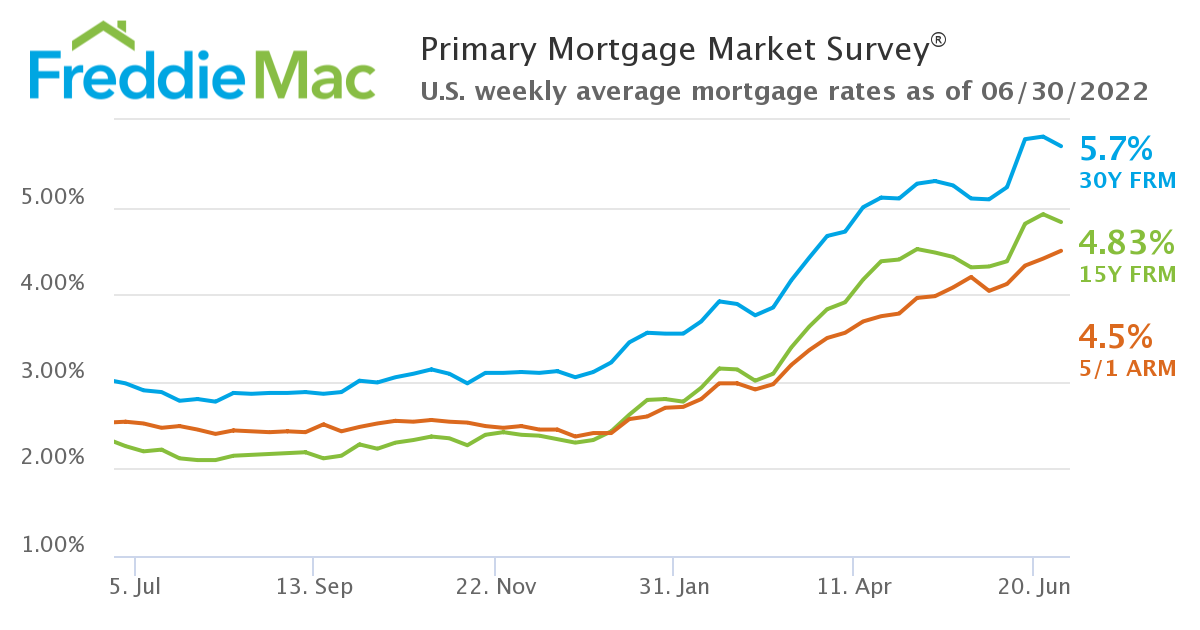

Mortgage rates are cooling off after sharply rising. But expect home prices to start slowing, and even dropping, in some of the most overheated markets in the country over the next couple of years.

With the average on the 30-year fixed-rate mortgage at 5.7%, some would-be buyers are spooked by the higher borrowing costs and are putting their plans on hold. A year ago, the rate was 2.72%.

The hesitation is starting to show up in proprietary data, Rick Palacios Jr., head of research at John Burns Real Estate Consulting, told MarketWatch. The company counts suppliers, builders and buyers (such as hedge funds) among their clients.

“The consensus is most forecasters … are anticipating prices to either flatten and/or go down next year, especially in a lot of these way overheated markets like Boise,” Palacios said.

Expect these declines to manifest more steeply in some parts of the country.

At a national level, he said he expected home prices to decline by mid-single digit percentages over the next two years.

It’s not just him. Capital Economics’ Matthew Pointon also expects a “small fall” in home prices of around 5% on a year-over-year basis by 2023, he said.

Having looked closely at many of the markets, Palacios expects an even more “meaningful price decline” in some of the popular pandemic destinations.

In a tweet on Tuesday, Palacios highlighted how his research firm saw the rate of change in home prices slow in a hot market like Boise, Idaho, after the Federal Reserve hiked interest rates, sending mortgage rates up sharply.

“Boise is the poster child,” Palacios said, and, in his firm’s view, may see a decline in home prices as early as this year.

“Boise is the poster child,” Palacios said, and, in his firm’s view, may see a decline in home prices as early as this year.

Inventory is climbing, too. Realtor.com data from June noted a 18.7% increase in the number of new homes available for buyers — the “fastest yearly pace of all time,” the company said. The biggest jumps in listings were in markets like Raleigh and Charlotte in North Carolina and Nashville on a month-over-month basis.

“The U.S. housing market is at the beginning stages of the most significant contraction in activity since 2006,” Len Kiefer, deputy chief economist at Freddie Mac, said earlier this month.

The official data is telling a different story, though: The sale of new single-family homes last month, despite the higher mortgage rates, rose by 10.7% compared with the previous month, according to the Commerce Department.

Original Article